27+ Finance interest calculator

The rate usually published by banks for saving accounts money market accounts. Now divide that number by 12 to get the monthly interest rate in decimal form.

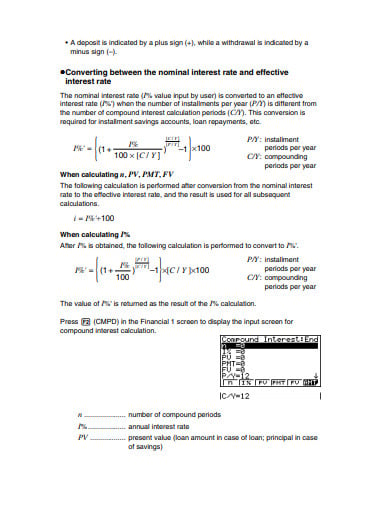

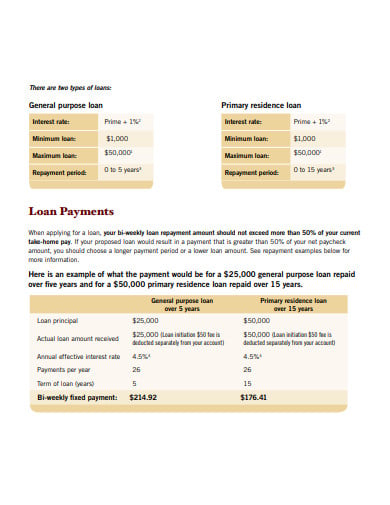

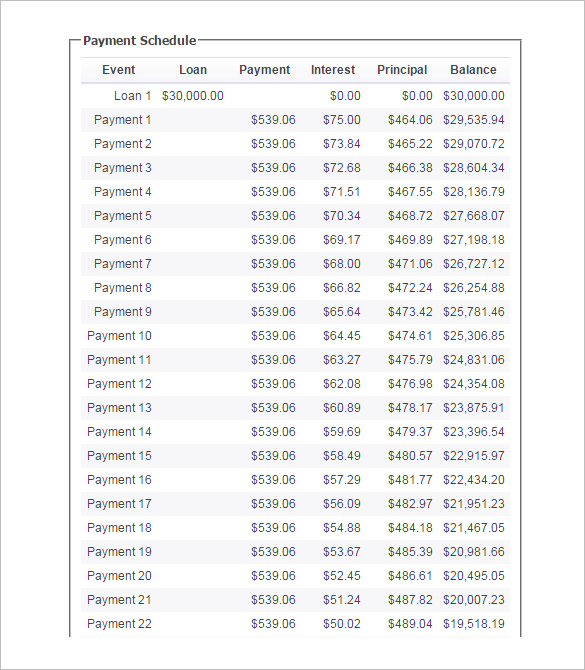

11 Loan Payment Calculator Templates In Pdf Doc Pages Free Premium Templates

Enter the loan principal amount in the appropriate field.

. To calculate the monthly interest on 2000 multiply that number by the total. The accrued interest calculator provides you with real time cost which you are going to pay for any loans that you decide to borrow. The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100.

P the principal the amount of. This is a complex process resulting in a more accurate interest rate figure. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

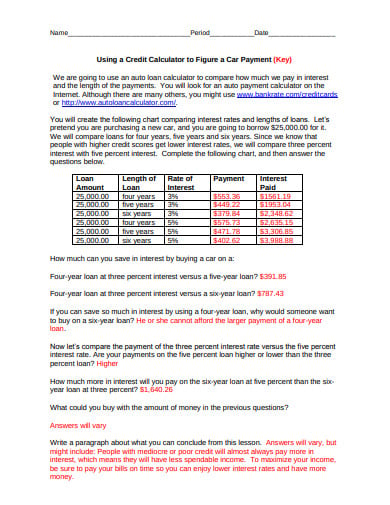

Thus the interest of the second year would come out to. To calculate the amortized rate you must do the following. The Advanced APR Calculator finds the effective annual percentage rate APR for a loan fixed mortgage car loan etc allowing you to specify interest compounding and payment.

I is the interest. Click on calculate Your only interest in payment value will get displayed. 110 10 1.

You may utilize it by following these steps. Multiply that number by the remaining loan balance to. Simply follow these steps.

The accrued interest calculator shows you the below. Enter the interest rate. How much will there be in one year.

Your calculation might look like this. PMT is the monthly payment. This 110 is equal to the original principal of 100 plus 10 in interest.

Divide your interest rate by the number of payments you make per year. Using a loan interest rate calculator is simple with the interface being quite user-friendly. P V P M T i 1 1 1 i n PV is the loan amount.

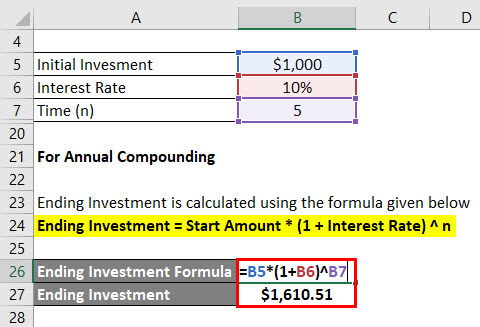

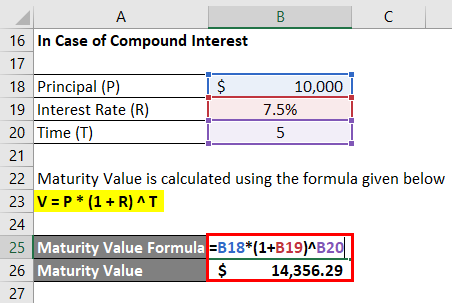

For loan calculations we can use the formula for the Present Value of an Ordinary Annuity. A P 1 rnnt. The compound interest formula solves for the future value of your investment A.

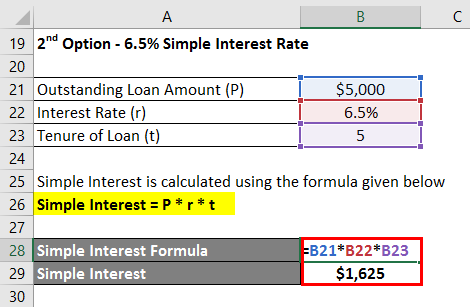

A P 1 rt P 5000. The compound interest formula is. Our calculator uses the Newton-Raphson method to calculate the interest rates on loans.

Lets say that we want to lend a friend 5000 at a yearly interest rate of 5 over 4 years. Loan interest is usually expressed in APR or annual percentage rate which includes both interest and fees. Assuming you pay off the mortgage over the full 30 years you will pay a total of 27976735 in interest over the life of the loan.

Enter the loan amount. 110 is the future value of 100 invested for one year at. That is almost the original loan amount.

The answer is 110 FV.

Interest Formula Calculator Examples With Excel Template

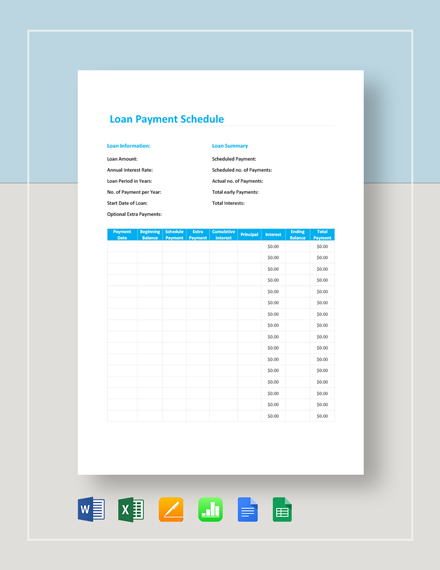

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

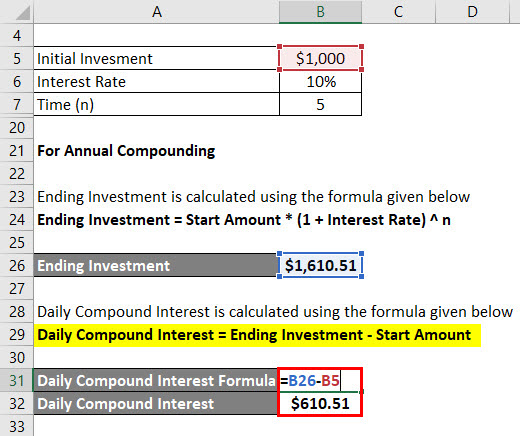

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

11 Loan Payment Calculator Templates In Pdf Doc Pages Free Premium Templates

11 Loan Payment Calculator Templates In Pdf Doc Pages Free Premium Templates

Maturity Value Formula Calculator Excel Template

Interest Formula Calculator Examples With Excel Template

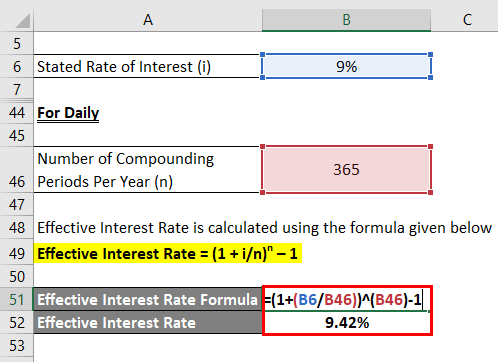

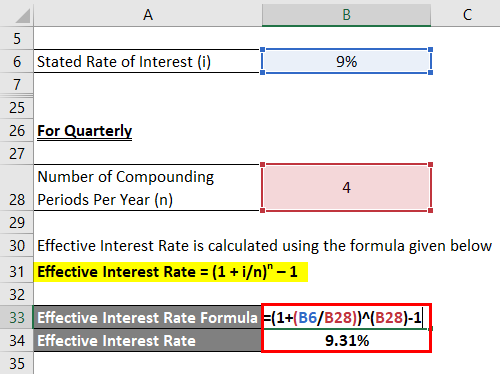

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Loan Templates

Real Estate Commission Calculator Templates 8 Free Docs Xlsx Pdf Real Estate Training Real Estate Templates

Effective Annual Rate Formula Calculator Examples Excel Template

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Maturity Value Formula Calculator Excel Template

11 Loan Payment Calculator Templates In Pdf Doc Pages Free Premium Templates

Effective Interest Rate Formula Calculator With Excel Template